No matter where you are on your journey toward financial freedom, these essential strategies will help you improve your financial capability and set you on a path to success.

Sign Up for Free Online Financial Education

Powered by iGrad® and Enrich®, FAME offers free online financial education to support Maine people during high school, college, and beyond.

How to get started:

- Visit FAME’s iGrad site (or Enrich if you’ve finished college) to sign up for a free account.

- Complete your financial wellness assessment.

- Browse recommended videos, articles, or complete a course.

Set Goals

Setting goals helps you identify where you want to go, what you will need along the way, and whether you are on course.

- Set realistic goals. Consider educational, financial, and personal goals.

- Prioritize – what matters most to you?

- Make a plan and determine what resources you need to achieve these goals.

- Track your progress.

- Congratulate yourself when you’ve reached a milestone!

Examples of Goals

Short-Term Goals

(within two years)

- Get your own apartment

- Pay down high-interest debt

- Create an emergency fund

Mid-Term Goals

(two to five years)

- Take a dream vacation

- Buy a home

- Go back to school

Long-Term Goals

(five+ years)

- Pay off student debt

- Start your own business

Get Organized

Getting organized will help you pay your bills on time and remember important deadlines. Here are five tips to help you get your financial life in order:

- Create a system to track billing statements, financial information, and any other important documents.

- Review your financial records and banking and billing statements regularly and look for any errors or mistaken charges, as well as any untracked payments.

- When following up on questions related to your bills or other money-related issues, keep a record of the name of the person you spoke to, the date of the conversation, and any information you discussed – especially any important instructions.

- Using free online bill-paying services can help you pay your bills on time. Designate a time each month to review and pay bills that are not automatically paid through your bank account.

- Keep important papers such as loan documents. Shred or recycle the rest, such as credit card offers and other junk mail.

Having trouble locating your student loan information?

Many students have multiple loans that may be serviced by different companies or even owned by different lenders. Knowing who to contact is critical to successful repayment. Visit:

Track Spending

Track your spending every day for a month to find out exactly where your money is going. Don’t forget small purchases – they can really add up!

Take note of areas where you may be spending more than needed and decide how to reduce or eliminate any unnecessary spending, also known as “spending leaks.” Mobile apps can help you track and categorize your purchases on the go. Use this information to build your budget or spending plan.

Spending leaks can add up! Have you identified yours?

- Daily coffee purchase, lunches out

- Music or app downloads

- Incurring avoidable bank fees (overdrawn account fees, fees for using ATMs through other banks, etc.)

- Impulse buying

Identify your leaks

- Track every penny you spend for an entire month.

- Review your expenses and identify whether the purchases or expenses are a “want” or a “need.”

Plug those leaks

- Make your own coffee and lunches at home.

- Stay away from clearance sales or impulse buying.

- Ask your bank or credit union if they offer overdraft protection.

Sign up for a free Enrich account, and learn how your daily expenses add up over time.

Create a Budget

Make a plan for your money. Creating a budget will help you manage your income and spending and reach your goals.

Six steps to creating a budget:

- Determine available income and resources.

- Make a list of your monthly and annual expenses and then categorize them.

- Identify whether expenses are “needs” or “wants.”

- Compare income and expenses.

- Create a budget that includes savings.

- Evaluate periodically and adjust your budget.

Adulting: Spending Plans

No one likes to feel out of control, especially when it comes to money. Take control of your money by creating a spending plan. This video will show you how.

Ideas for Reducing Expenses

Cell Phones, Cable, and Internet

- Eliminate the extras, such as cable or premium channels.

- If you have a cell phone, can you eliminate your landline?

- Do you pay excess fees for texting or data?

Personal Expenses

Beyond paying for the necessities, how much do you spend on your wants? Are there other ways you can satisfy those wants?

- Could you satisfy your desire for a new outfit by shopping at a thrift store instead of the mall?

- Try hosting a potluck instead of an expensive meal out.

Travel Expenses

- Can you carpool, use public transit, ride a bike, or walk?

- Are you getting the best deal on car insurance?

Housing Costs

- Are there ways that you can reduce your rent or mortgage costs?

- Have you considered a roommate?

- Are you getting the best deal for renters or homeowners insurance?

Food Costs

- Can you eat at home more often?

- Do you pack a lunch or make your own coffee?

- Do you buy in bulk when possible, cut coupons, and shop for sale items?

Utility Costs

- Are there ways to reduce your electricity, heat, water, or other utilities?

- Do you turn down your thermostat when you’re not at home? Can you install an automatic thermostat?

- Do you turn off the lights when you leave the room?

Take Advantage of Free Banking

- Many banks and credit unions offer free checking, and some allow you to earn money on your savings and checking accounts.

Complete a “Checkup”

Take a look at all of your fixed monthly expenses such as cable, cell phone, insurance, interest rates on loans, and banking fees. Make sure you are getting the best deal. Many of your monthly expenses are negotiable. Find some time to research and you may save big! Use this “found money” to start saving.

Ideas for Reducing Expenses Before and During College

There are a number of helpful ways to reduce your expenses before you pursue higher education and while you are attending college:

Before You Start College or Training After High School

Maximize college credits during high school. Credit you earn from Advanced Placement or community college classes you take while in high school may transfer as college credits and this will help you save on college tuition.

Attend an in-state school or take core classes at a community college. Both options may lower the cost of core classes. If you plan to transfer during your college education, make sure that your prospective college will allow transfer credits.

Shop around for the best options for room and board. Compare the costs of on-campus and off-campus living arrangements. Strongly consider living at home if that is an option. Research the full costs of renting an apartment and explore roommate options.

Ask friends and family for money for your college fund. Instead of graduation gifts, ask for contributions for your higher education savings. Even better, see if your college savings plan offers a gifting program where gifts can be contributed directly.

Get a part-time job. Every extra dollar you earn is one that you won’t have to borrow for school, and the experience will serve you well for the future.

While You Are Attending College or Training After High School

Find a part-time job on campus. Many colleges and local organizations offer part-time jobs for students. Think about working at a local business or in some capacity in the field you intend to pursue.

Choose your classes carefully. Make smart choices for classes and try to graduate in four years or less.

Buy used books or share. Textbooks can come with a hefty price tag. Look around for discount bookstores or buy used books from your campus bookstore. If you share classes with your roommate or friends, offer to share textbooks.

Find roommates. Share the cost of housing with other people.

Ditch your car. Does your campus have public transportation or ride sharing? Leave your car at home to save on parking, gas, insurance, and maintenance.

Eat at the dining hall. You’ll probably have to pay for a meal plan anyway, so use it for daily meals instead of spending additional money on groceries and restaurants.

Maximize the free fun on campus. Seek out free concerts, lectures, events and other things to do on campus that are free, to reduce your entertainment expenses.

Work out at your school gym instead of paying for a private gym membership. Many campuses have excellent fitness facilities at no cost. Take advantage of them to reduce your expenses.

Consider graduating early. Take classes over the summer or add more courses during the year to finish a semester early, which can save you housing costs.

Start Saving and Investing

Talk with a qualified expert about your retirement plans. Be sure to check with your employer; many companies will match your retirement savings. You may also be able to discuss investment options with your bank or credit union.

Consider saving for higher education. Having savings available for college can reduce the need to borrow.

Understand Taxes and Insurance

There are a few expenses in life that you simply can’t avoid — taxes and insurance top that list.

Taxes

Individuals and most businesses are required to pay a portion of their income to the federal government and to most state and some local governments. Many factors influence how personal and business income is taxed. Learn more: IRS.gov/individuals

In Maine, the CA$H Coalition provides free IRS-certified tax preparation for households and individuals who meet certain income requirements. Visit CASHmaine.org for more information or to locate a CA$H site near you.

Insurance

Insurance is a tool to help individuals manage risk in the event of an unexpected accident or injury and is a critical component to a sound financial plan. To obtain insurance, you must pay insurance premiums. In Maine, all drivers are required to carry a minimum amount of car insurance coverage. Many colleges require students to have health insurance and automatically charge for insurance. If you have health insurance (through your parents, for example), be sure to waive the school’s health insurance.

There are a number of free resources available to help you learn more:

Protect Your Money and Identity

Identity theft occurs when someone uses your personal information to make purchases, withdraw money, access credit cards, receive tax returns, or secure loans without your approval. Victims of identity theft are often left with debt and credit problems.

Tips to protect your money and identity:

- Watch out for companies that charge to apply for scholarships, help with student loans, or file the FAFSA. Free help is available from FAME.

- Shred financial documents before discarding, including credit card offers that you receive in the mail. Take advantage of paperless billing.

- Secure and password-protect your smartphone and computer. Install antivirus software, don’t click on links in unsolicited/unknown email messages, and don’t use obvious passwords.

- Consider placing a security freeze or fraud alert on your credit report. Visit Consumer.FTC.gov to learn more.

- Avoid high interest rates and fees. While payday loans, rent-to-own, or other financial products may offer cash advances, furniture, or electronics, they usually come at a very high price.

- Hold your mail at the post office when you’re away.

- Use caution when shopping or banking online and when sharing information on social media.

- Monitor your financial information, including your bank statements and credit report, and act quickly if you suspect identity theft. Memorize your Social Security number for when you need it.

There are a number of resources to help you protect your identity and avoid fraud:

- Federal Trade Commission

- Consumer Financial Protection Bureau

- Maine Bureau of Consumer Credit Protection

Review Your Credit Report

Your credit report is a snapshot of your financial life. It reflects whether or not you pay your bills on time, the total amount of credit extended to you, and how much you owe on all your accounts.

Credit scores range from 300 to 850. A score above 700 usually suggests good credit management. Download this helpful tool to learn more about your credit score and how it is determined.

What is on my credit report?

- Your name, Social Security number, date of birth, current and previous addresses and employers

- Credit account information, such as date opened, credit limit, balance, monthly payment, and payment history

- Bankruptcy, unpaid taxes and, in some states, overdue child support

Who could look at my credit report?

- Potential creditors

- Landlords

- Current or potential employers

- Government licensing agencies

- Insurance companies

What are the consequences of credit mistakes?

Negative information found on your credit report can have a serious impact on your ability to:

- Borrow money

- Get a job

- Advance in your current job

- Rent or buy a home

How long does information stay on my credit report?

- Positive information remains on your credit report indefinitely.

- Credit inquiries are included for six months to two years.

- Most negative information stays on your report for seven years.

- Some bankruptcies and foreclosures may remain for as long as ten years.

Credit Bureaus and Reports

Understand Your Credit Score

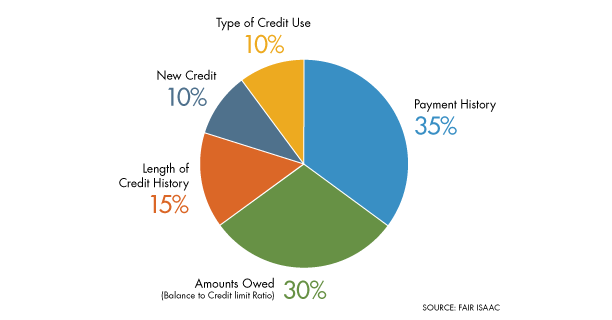

If your credit report is your financial report card, think of your credit score as your GPA. Your credit score is a number calculated on your past habits and activities. A FICO score, which is the most commonly used score, ranges from 300 to 850 and is used as a measure of your creditworthiness. A score above 700 usually suggests good credit management.

How is your credit score determined?

Your credit score is based on your past use of credit, such as through loans (auto loans, student loans, mortgages) and credit cards, and is calculated based on the following:

Take Control of Your Debt

Some debt may be necessary, such as borrowing to buy a home or to pay for college. Borrowing for things like vacations and meals leaves you with debt and little reward. Only borrow what you can reasonably afford to repay. If something takes longer to pay for than it lasts, don’t borrow money to buy it.

What are the consequences of credit mistakes?

Negative information found on your credit report can have a serious impact on your ability to:

- Borrow money

- Get a job

- Advance in your current job

- Rent or buy a home

How long does information stay on my credit report?

- Positive information remains on your credit report indefinitely.

- Credit inquiries are included for six months to two years.

- Most negative information stays on your report for seven years.

- Some bankruptcies and foreclosures may remain for as long as ten years.