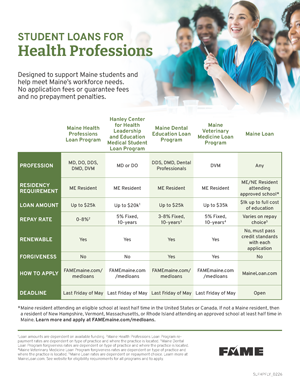

These loans for health professionals were designed to support Maine students and help meet Maine’s workforce needs.

Maine Dental Education Loan Program

The Maine Dental Education Loan Program is a competitive, forgivable loan program for Maine residents pursuing dental education leading to a career as a dentist or other dental auxiliary profession and demonstrate an interest in practicing in underserved areas in Maine.

Details and How to Apply

Eligibility

- Be admitted to a program of dentistry at an institution of medical education that has been accredited by the appropriate accreditation agency or enrolled in any accredited school in a program of study for dental hygienists, dental therapists, expanded function dental assistants or dental assistants;

- Maine resident (for purposes other than education) for two years prior to the time you enter the above described program;

- Demonstrate an interest in practicing primary dental care in an underserved population area in Maine and in serving patients regardless of their ability to pay; and

- Exhibit financial need.

Priority is given to eligible applicants with the greatest financial need and a demonstrated intent to practice primary dental care in an underserved area in Maine. Finalists may be required to participate in an interview.

Loan Amounts

- Up to $25,000 annually, up to $100,000 total, if the first program loan is received after January 1, 2020

- Up to $20,000 annually, up to $80,000 total, if the first program loan was received prior to December 31, 2019

Loan funds are paid directly to the school for credit to your student account.

Renewals

To receive renewal funding, the online renewal application must be completed on or before June 1. The FAFSA must be filed by June 1.

FAME emails renewal application links to current recipients by the end of February. Please make sure we have a current email address on file.

How to Apply

Applications for the 2026-2027 academic year are no longer being accepted.

- The application for the Maine Dental Education Loan Program must be completed and submitted online. You will not be able to save an application in progress and return to it later—once you begin the application, you will need to complete it.

- Before you begin, have all documents required to complete your application saved as PDF files:

- Letters of acceptance into an eligible program

- Copies of all undergraduate and graduate academic transcripts

- Copies of your 2024 and 2025 state income tax returns (do not include schedules)

- Copy of your current driver’s license or state-issued non-driver ID

- Copy of your vehicle registration (indicate if you do not have one)

- The program application link below will direct you to FAME’s online application system.

- Review the following documents included in the application:

- Application Guidelines & Checklist

- Private Education Loan Application & Solicitation Disclosure

- Complete and submit the online application along with all required documents by June 1, 2026. Applications submitted without all required documents will be considered incomplete.

- Submit the 2025-2026 FAFSA (Free Application for Federal Student Aid) by June 1, 2026.

Loan Forgiveness

Maine Dental Education Loan recipients may be eligible for loan forgiveness. To receive loan forgiveness, a dentist or other dental auxiliary professional must practice primary dental care full time in an underserved area of the state, in an eligible dental care facility.

Eligibility for Forgiveness

Dentists, dental hygienists, dental therapists, expanded function dental assistants, or dental assistants who practice primary dental care in an eligible dental care facility in an underserved area of Maine may be eligible for loan forgiveness at the rate of 25% of their original outstanding indebtedness on an annual basis.

“Dental care facility” means:

- Any health care facility that offers primary dental care as either its primary service or as part of a broader medical practice;

- Accepts payment through MaineCare or successor program;

- At which at least 25% of the patient load has been accepted for treatment regardless of ability to pay through insurance or other payment source; and

- Provides patients notice that it accepts payment through MaineCare or a successor program.

Applying for Forgiveness

Contact FAME as soon as you secure employment. We will determine loan forgiveness eligibility. To apply for forgiveness, complete and submit the online Annual Report each year. FAME emails links to the online Annual Report every year in early spring.

Recipients must provide documentation that they have practiced primary dental care in an eligible dental care facility in an underserved area. Loan recipients may receive partial loan forgiveness on a pro-rata basis if they fulfill all the criteria but maintain the appropriate practice for less than a year.

If You Are Not Eligible for Forgiveness

Repayment must be completed according to the terms specified in your promissory note. Loan repayment will begin six months following the month you complete your professional education or withdraw. Interest is calculated based on the rate disclosed in your promissory note.

If You Are Having Difficulty Making Your Monthly Payments

Contact FAME to discuss alternative payment arrangements. Deferments may be granted in certain circumstances. You can download a Request for Deferment form here. We typically require interest payments during periods of deferment and do not grant more than a total of 36 months of deferment.

This program is governed by Maine law as set forth in 20-A M.R.S.A. § 12301 et seq. and Chapter 612 of the Rules of the Finance Authority of Maine.

Maine Health Professions Loan Program

The Maine Health Professions Loan Program is a need-based, competitive loan for Maine students pursuing postgraduate medical, dental, and veterinary education.

Details and How to Apply

Eligibility

- Must be admitted to a program of allopathic, osteopathic, veterinary medicine, or dentistry at an accredited institution of medical education which culminates in a M.D., D.O., D.M.D. or D.D.S., or D.V.M. degree.

- Must be a Maine resident (for purposes other than education) for one year prior to matriculation into medical school

- Demonstrate financial need

Loan Amounts and Interest

Up to $25,000 annually, up to $100,000 total for a maximum of four years. Doctors for Maine’s Future Scholarship recipients may not receive more than $10,000 annually, up to $40,000 total for a maximum of four years.

No interest accrues while the recipient is in an eligible residency program. During repayment, the interest rate can be as low as 0% and is based on location and type of practice and/or population served.

Loan funds are paid directly to the school for credit to your student account.

Renewals

Loans are renewable provided funding is available. To apply, the online renewal application must be completed on or before June 1. The FAFSA must be filed by June 1.

FAME emails renewal application links to current recipients by the end of February. Please make sure we have a current email address on file.

How to Apply

Applications for the 2026-2027 academic year are no longer being accepted.

- The application for the Maine Health Professions Loan must be completed and submitted online. You will not be able to save an application in progress and return to it later—once you begin the application, you will need to complete it.

- Before you begin, have all documents required to complete your application saved as PDF files:

- Essay (see application Guidelines for topic and requirement)

- Copies of all undergraduate and graduate academic transcripts

- Copy of your 2025 state income tax return

- Copy of your current driver’s license or state-issued non-driver ID

- Copy of your vehicle registration (indicate if you do not have one)

- The application link below will direct you to FAME’s online application system.

- Review the following documents included in the application:

- Application Guidelines & Checklist

- Private Education Loan Application & Solicitation Disclosure

- Complete and submit the online application along with all required documents by June 1, 2026. Applications submitted without all required documents will be considered incomplete.

- Submit the 20265-2027 FAFSA (Free Application for Federal Student Aid) by June 1, 2026.

How Students Are Selected

Priority is given to students who have the greatest financial need. Further priority is given to allopathic and osteopathic students not participating in Doctors for Maine’s Future Scholarship Program, then to dental and veterinary students.

Loan Repayment Chart

| Practice Type and Location | Annual Interest Rate |

|---|---|

| 1. Primary health care physicians and general dentists practicing at least 20 hours/week in a Health Professional Shortage Area (HPSA) in Maine. | 0% |

| 2. Veterinarians practicing in areas of Maine with insufficient veterinary services and providing at least 20 hours/week of veterinary services to livestock | 0% |

| 3. Primary health care physicians and general dentists attending to patients at least 20 hours/week in a non-HPSA in Maine; any physician attending to patients at least 20 hours/week in an underserved specialty in Maine; any physician attending to patients in an underserved population group in Maine at least 20 hours/week | 3% |

| Practicing in Maine but not subject to 1, 2, or 3 above. | 5% |

| Not practicing in Maine or withdrew from professional education. | 8% |

Students who obtained their first program loan prior to January 1, 2011 are subject to different provisions. Learn more about repayment and forgiveness for borrowers with an initial loan made prior to January 1, 2011.

If You Are Having Difficulty Making Your Monthly Payments

Contact FAME to discuss alternative payment arrangements. Deferments may be granted in certain circumstances. You can download a Request for Deferment form here. We typically require interest payments during periods of deferment and do not grant more than a total of 36 months of deferment.

This program is governed by Maine law as set forth in 20-A M.R.S.A. §12101 et seq. and Chapter 617 of the Rules of the Finance Authority of Maine.

Hanley Center for Health Leadership & Education Medical Student Loan Program

Formerly Maine Medical Education Trust Medical Student Loan Program

The Hanley Center for Health Leadership and Education Medical Student Loan Program provides funding to Maine residents enrolled in or accepted to approved medical schools. These loans can be used to fill the gap between federal loan programs and the full cost of education.

The Hanley Center for Health Leadership & Education (HCHLE), a 501(c)3 nonprofit corporation, was established in 1989 and is dedicated to supporting medical education in Maine.

Details and How to Apply

Benefits of an HCHLE Medical Student Loan:

- No application or origination fees

- No interest accrues while in school

- Low, fixed interest rate during loan repayment

- Free membership in the American Medical Association while in school

- Free membership in the Maine Medical Association while in school

- High-quality customer service center located in Maine

- Extended residency period: Students may now defer principal payments for up to five years after graduation from medical school.

- Deferment of interest payments for up to five years of residency. Students will receive optional interest statements during this period.

- Repayment period extended: A ten-year term begins when the loan enters full repayment of principal and interest.

Terms and Eligibility

- Maine residents accepted by or enrolled in approved medical schools

- A resident is an individual who has lived in the state of Maine (for purposes other than education) for one year prior to acceptance or enrollment in an approved medical school.

- Similarly, the spouse or domestic partner of a person who has continuous, full-time employment in Maine at the time of medical school acceptance or enrollment is considered a resident.

- Absent documentation of residency or ties, an applicant who has resided in Maine solely to attend an in-state institution is considered a non-resident.

- Must be a member of the American Medical Association and the Maine Medical Association (paid for by HCHLE)

- No application or origination fees

- Depending on resources available, loan amounts can be up to $25,000 and have historically ranged from $2,000 and up

- Disbursements are payable to the student and mailed directly to the address provided on the application

- Application deadline: June 1 of award year

- Student must be pursuing a degree of Doctor of Medicine (MD) or Doctor of Osteopathic Medicine (DO)

Interest Rate

- No interest accrues while the student is in medical school at least half-time

- Low, fixed interest rate of 5%* during repayment

- Tiered interest rate while student is in residency program (up to 5 years)

| Year | Interest Rate |

|---|---|

| 1st | 1% |

| 2nd | 3% |

| 3rd – 5th | 5% |

Repayment Options

- No payments are due while the student is enrolled at least half-time in medical school.

- Interest-only statements sent during residency period. Students are strongly encouraged to make optional interest only payments during this time to reduce the overall cost of repaying loan.

- Ten-year repayment term: full repayment begins upon completion of medical residency, five years after graduation from medical school, or upon withdrawal from medical school or residency.

- Forbearance periods are allowed for up to 24 months on a case-by-case basis. You can download a Forbearance Request form here. Education Program Specialists, located at FAME in Maine, are ready to assist you: 1-800-228-3734, Education@FAMEmaine.com.

How to Apply

Applications for the 2025-2026 academic year are no longer being accepted.

- Before you begin, prepare all documents required to complete the application:

- New applicant entering medical school

- Copy of acceptance letter to medical school

- Letter of recommendation from dean of college most recently attended. This letter should contain basic information about the applicant including accomplishments, activities or groups of involvement, and historical grades.

- AMA membership application or proof of membership

- New applicant currently attending medical school

- Letter of good standing from medical school dean

- AMA membership application or proof of membership

- Renewal applicant

- Letter of good standing from medical school dean

- New applicant entering medical school

- Download the application via the program application link below.

- Review the following documents included in the application packet:

- Application Guidelines & Checklist

- Private Education Loan Application & Solicitation Disclosure

Mail the completed application package to:

Hanley Center for Health Leadership and Education Medical Student Loan Program

c/o Finance Authority of Maine

PO Box 949

Augusta, ME 04432-0949

Renewals

To receive renewal funding, the paper renewal application must be completed and received by FAME on or before June 1.

FAME mails paper renewal applications to current recipients by the end of February. Please be sure we have a current email address on file.

Benefits of MMA/AMA Membership

Medical students borrowing from HCHLE also become student members of the Maine Medical Association and the American Medical Association. This membership is extended to borrowers without cost, as HCHLE pays for the cost of the multi-year AMA membership, and MMA membership is free to medical students and residents. These memberships provide a medical student with the same types of benefits that active physician members receive.

Maine Veterinary Medicine Loan Program

The Maine Veterinary Medicine Loan is a competitive, need-based, forgivable loan for Maine students pursuing a career as a veterinarian. The number of loans awarded each year is limited and depends on the availability of funding. Borrowers may have a portion of their loan forgiven for each year of eligible return service.

Details and How to Apply

Eligibility

- Students must be residents of Maine (for purposes other than education) for two years prior to matriculation at a veterinary school.

- Students admitted to a program of study at an accredited school leading to a Doctor of Veterinary Medicine degree. Entry into veterinary school must be after January 1, 2011.

- Students who demonstrate a desire to practice veterinary medicine related to livestock[1] or emergency and critical care in an area of Maine with insufficient veterinary services, or to practice veterinary medicine of any type in an underserved geographic region in Maine.[2]

- Must exhibit financial need.

[1] “Livestock” means such animals as determined by the Maine Commissioner of Agriculture, Conservation & Forestry.

[2] “Underserved geographic region” means a geographic region of Maine in which there is an insufficient number of practitioners of veterinary medicine, as determined by the Maine Commissioner of Agriculture, Conservation & Forestry.

Loan Amounts and Interest

The maximum annual loan amount is $35,000 for loans made for the 2026-2027 academic year, up to a maximum of $140,000 for a maximum of four years. No interest accrues while the recipient is in an eligible medical program. During repayment, the interest rate can be as low as 0% and is based on location and type of practice and/or population served.

Loan funds are paid directly to the school for credit to your student account.

Renewals

Loans are renewable if funding is available. To receive renewal funding, the online renewal application must be completed on or before June 1. The FAFSA must be filed by June 1.

FAME emails renewal application links to current recipients by the end of February. Please be sure we have a current email address on file.

How to Apply

Applications for the 2026-2027 academic year are no longer being accepted.

- The application for the Maine Veterinary Medicine Loan Program must be completed and submitted online. You will not be able to save an application in progress and return to it later -once you begin the application, you will need to complete it.

- Before you begin, have all documents required to complete your application ready to upload as PDFs:

- Essay (see application guidelines for topic and requirements)

- Copies of your 2024 and 2025 state income tax returns (do not include schedules)

- Copy of your current driver’s license or state-issued non-driver ID

- Copy of your vehicle registration (Indicate if you do not have one)

- The application link below will direct you to FAME’s online application system

- Review the following documents included in the application:

- Application Guidelines & Checklist

- Private Education Loan Application & Solicitation Disclosure

- Complete and submit the online application along with all of the required documents by June 1, 2026.

- Submit the 20256-2027 FAFSA (Free Application for Federal Student Aid) by June 1, 2026.

Loan Forgiveness

Maine Veterinary Medicine Loan recipients may be eligible for loan forgiveness. Download FAME’s brochure about forgiveness eligibility for more information.

Eligibility for Forgiveness

Maine Veterinary Medicine Loan recipients (who started their education on or after January 1, 2011) may be eligible for loan forgiveness.

Borrowers may have a portion of their loan forgiven for each year of eligible return service.

| Type of Practice or Practice Site | Forgiveness Rates and Time Frame | Interest Rate % |

|---|---|---|

| Practice veterinary medicine full-time in an area of Maine with insufficient veterinary services and whose practice is devoted to livestock or emergency and critical care, or who practice veterinary medicine of any type in an underserved geographic region, at least 20 hours per week as determined by the Maine Department of Agriculture, Conservation and Forestry. | 25% of original total loan amount for each full year of practice. Return service must be performed within ten years of postgraduate veterinary medical training. | N/A |

| Practice veterinary medicine full time in an area of Maine with insufficient veterinary services and whose practice is devoted to livestock or emergency and critical care, or to veterinary medicine of any type in an underserved geographic region, as determined by the Maine Department of Agriculture, Conservation and Forestry, less than 20 hours/week, but not less than 10 hours/week. | 12.5% of original total loan amount for each full year of practice. Return service must be performed within ten years of postgraduate veterinary medical training. | N/A |

| Practice veterinary medicine less than full time in an area of Maine with insufficient veterinary services, but devote at least 10 hours per week to the care of livestock or emergency and critical care veterinary medicine of any kind in an underserved geographic region, as determined by the Maine Department of Agriculture, Conservation and Forestry. | 12.5% of original total loan amount for each full year of practice. Return service must be performed within ten years of postgraduate veterinary medical training. | N/A |

| Do not practice veterinary medicine in Maine, or live and work out of state. | 10-year repayment period. | 5% |

Applying for Forgiveness

Contact FAME as soon as you find employment to confirm your loan forgiveness eligibility. To apply for forgiveness, complete and submit the online Annual Report each year. FAME emails links to the online Annual Reports every spring.

If You Are Not Eligible for Forgiveness

Repayment must be completed according to the terms specified in your promissory note. Loan repayment will begin six months following the month you complete your professional education or withdraw. Interest is calculated based on the rate disclosed in your promissory note.

Additional Questions?

If you still have questions, please contact a FAME Education Program Specialist Monday through Friday, 8:00 a.m. to 4:00 p.m.

207-623-3263 | Toll-free: 800-228-3734 | TTY: 207-626-2717