The Tough but Important Fight for Financial Education

Seville, Spain, sometime in 2018, English conversation class for college students. The topic: money.

“Credit score, credit bureaus… Oh boy, it’s tough to translate something that doesn’t exist in Spain. In fact, nearly all of Europe and most of the world do not use credit scores and don’t have centralized credit reporting agencies,” I told this class, as I had told many before, both in Spain and the Czech Republic.

“Can you explain it to us?” they asked.

“I’m not sure, but I will enjoy trying,” I replied, wondering if they had seen Fight Club.

The American economic system is complicated (in casual conversations a stronger adjective is needed), and navigating our system when it comes to personal finance is complicated times ten. This is true in a vacuum and is especially obvious when compared to other countries. Yes, “land of opportunity” still rings true, and I say that after living abroad for 10 years and having taught students from more than a dozen countries. But the costs of that opportunity (sweet economics pun for anyone paying attention to such things) are the sometimes mile-high and spiky hoops we must jump through to get to, and maintain, those opportunities.

What makes it complicated? Hmm… Let me see if I can think of a few things:

- Credit scores

- The cost of higher education and student loans

- Relatively easy access to credit

- Predatory lending, check-cashing businesses, rent-to-own, etc.

- Health care costs and access to affordable insurance

- Social security

- The national debt

- The non-stop marketing machine that drives consumer society

Exhale. I realized I was holding my breath as I was typing. I further realized that I’d better stop there so as not to turn the whole blog into a list.

Oops, I can’t leave this one off the list: a lack of financial education to help face those challenges.

I can’t say these issues don’t exist in other countries. But I can say from personal experience and research that Nobody Does it Better than US, and “better” in this case is not always a good thing. Yet even with those challenges, America is still near the top of any list in terms of personal economic opportunity.

Has it always been so tough? In some ways it was certainly tougher on Americans before stronger labor laws, social security, banking regulations, and relative progress towards economic equality for all regardless of gender, race, or ethnicity. But some things have gotten worse, or are relatively new problems, such as easy access to credit and the consequences it brings. Statistics on credit card use and debt are easy to find and understand, but not easy to put into perspective. One thing is clear: in 1970, less than 50% of Americans had a credit card, and now it’s over 90%. Yes, convenience and technology are a part of that, and some of the side effects of credit card use are objectively good (safety compared to cash, cross-marketing benefits, etc.).

All Together Now

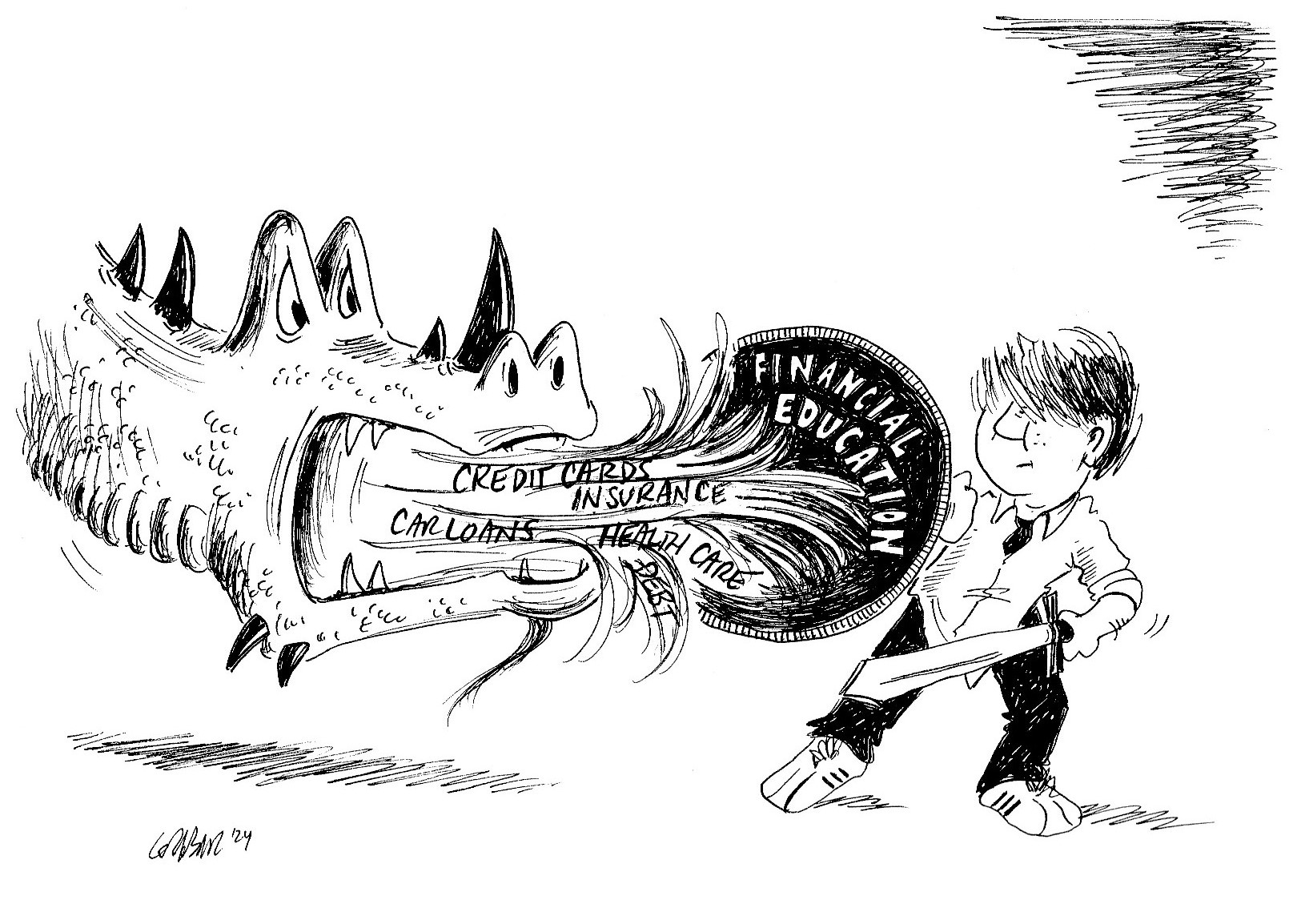

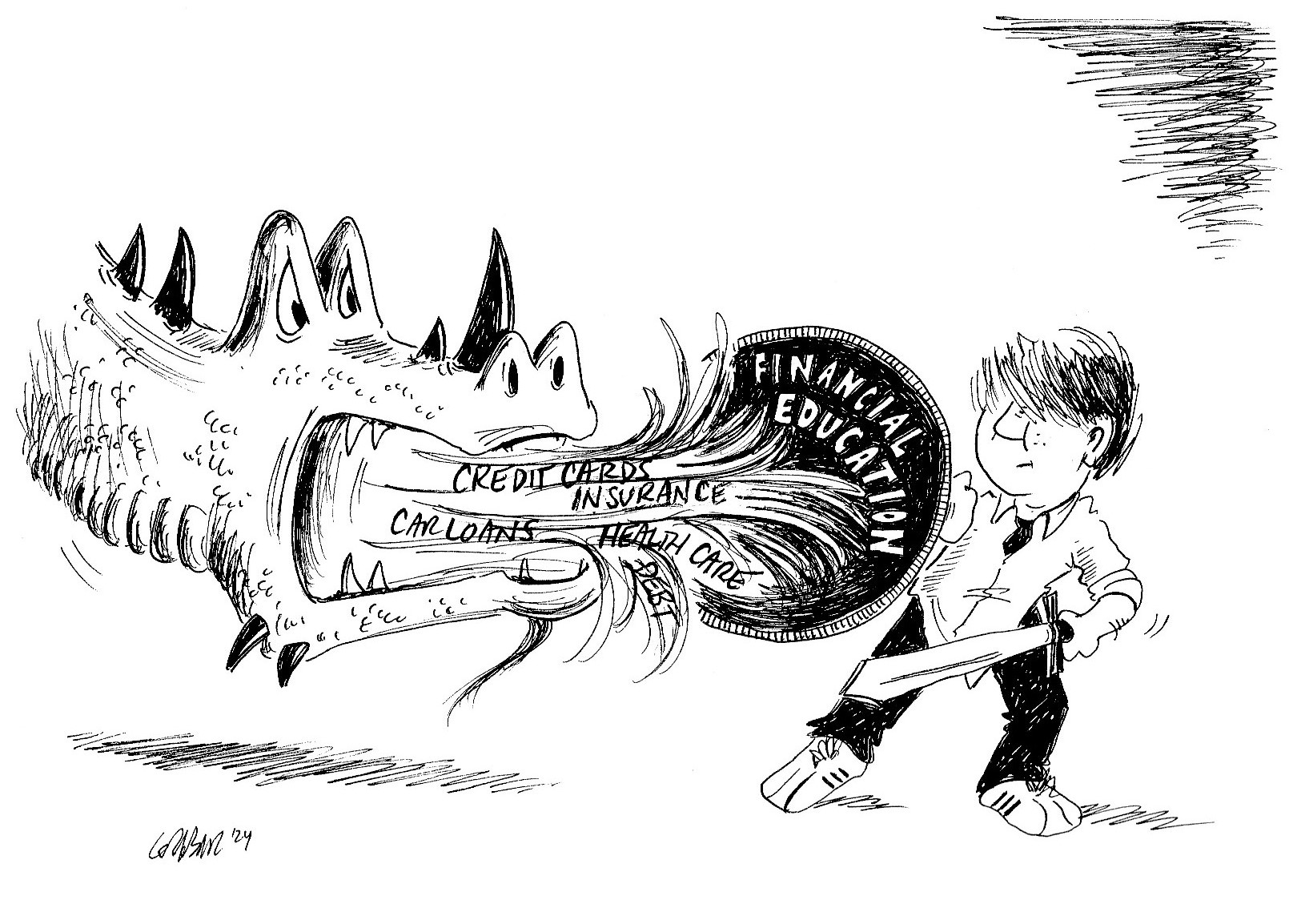

The connection to the complicated American financial system is that when it’s so easy to get credit, it’s so easy to misuse it, pile up debt, and make a real financial mess. Yet, as a nation, we allow our 18-year-olds into this system without the educational foundation (a shield) to understand and protect against the double-edged sword of compound interest.

The generations responsible for allowing financial education to be largely ignored have an excuse; it wasn’t that long ago that credit cards were not easily available, people got jobs that they kept for 30 or 40 years which provided health care and pensions, a college degree was not in as high demand or as expensive (adjusted for inflation), there were no 72-month, $40,000 car loans, and our life expectancy was not a decade or more longer than our career expectancy.

It’s no one’s fault that it’s so tough out there. Our society and its unprecedented economic experiment have evolved, and there is plenty of good in that evolution. It will be everyone’s fault, however, if we don’t catch up and better prepare our new adults to step into the financial funhouse that we call American capitalism.

So, I ask myself again today, “What can I do to help one student, one class, one person, not only survive our system but learn to thrive in it?” Won’t you join me?

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.