The Non-Financial Impact of Financial Decisions

Remember the ads about some things being priceless? “There are some things money can’t buy. For everything else, there’s Mastercard.” No matter what card we use or how we feel about credit in general, it was an effective campaign. And there was something to the message—some things are priceless.

In closing out the second year of this blog – this being the 24th post—and closing out 2025, I want to go boldly past the dollars and cents, the credit scores, mortgage rates, budgets and investments, and take a look at dollars and sense, with sense referring to why personal financial “success” is important beyond the numbers in our bank account.

Financial wellness means something different to all of us, and that’s a good thing. I don’t teach personal finance with “get rich”, “make a zillion bucks”, or “retire wealthy” as blanket ideals. I try to help folks learn how to manage their finances within an unruly and complicated system so that they can pursue their goals, whether that means building wealth, changing generational perspectives about money, or finding a way to do meaningful work without worrying about how much it pays. Again, our system is messy and loaded with potholes, and even if your goals are non-financial, it takes financial savvy to get there.

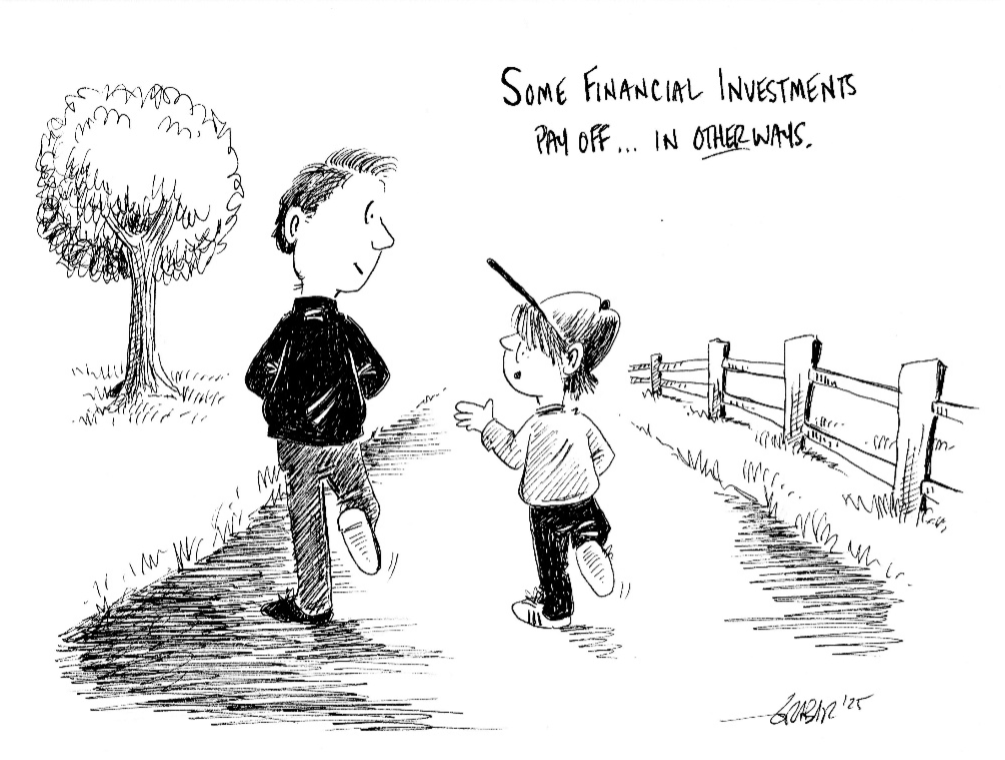

And that’s all very personal. For me, financial wellness has categories and milestones, some with $$ but not all. The example I offer today is about walking my kid to school.

(I Didn’t Know) The Impact of Better Money Decisions

When I began to rewrite my personal finance story, I was thinking about my future self, but mostly if not wholly in the context of building up my bank account, probably for the purpose of what it could buy me later in life. Not bad. And the future me stuff was right on target. But what I didn’t know at the time (or didn’t think about) was that a day would come when a stronger financial foundation would be used to fund choices that ultimately have nothing to do with money and are in fact priceless.

This is an excerpt from an essay I wrote a few years ago, highlighting (and counting) the time I was able to spend walking my son to school.

Starting from when he was about one, he has tallied about 1,500 school days. That is about 3,000 trips counting both directions. Five of those years have been in Spain, making up about 1,750 of those 3,000 trips. Of those 1,750, I estimate that I have walked with him on more than 90% of those days. That comes to about 1,600 walks to or from school with my boy. I would apply an even higher ratio from when we lived in Portland, with me having walked or driven him nearly 95% of the time. Let’s call that another 1,200 legs. I’ve walked him to school or back nearly 2,800 times.

I wrote that a few years ago and can now add a few hundred more to that total even though now he usually walks by himself, not necessarily wanting his folks tagging along.

Yes, That’s Priceless! What Does It Have to Do with Money?

The seven years we lived in Spain and all of those walks to school and other places, were largely possible because I was a stay-at-home dad. Part of the reason I could do that was my wife’s career, but if I had not gotten my finances straightened out years earlier, I wouldn’t have been able to sell my home, pack up a few boxes, move across the ocean, and use savings and investments to fund my portion of the adventure. My wife had a good job in Spain, but she was not making a huge salary, we lived in a spartan apartment, owned a very old car, and kept things really simple financially.

Specifically, but not necessarily in order, this was the path that led to those priceless walks:

- Get spending under control

- Use a budget

- Pay off credit card debt and car loans and never go back

- Save for a down payment and buy a modest (to say the least) fixer-upper home

- Rent a room in that home for several years, offsetting expenses and paying down mortgage

- Begin retirement saving

- Investing savings and proceeds from home sale to help with Spain expenses and expectation of little to no income for several years

Questions:

- Could I have still spent the time taking those thousands of walks with my son if I hadn’t gotten my finances in order?

NO, I would have been working four jobs in order to manage my debt, or I would have been doing a job I hated just for the money and/or I would not have been able to be a full-time dad for those years in Spain. - What exactly was the payoff of improved money habits?

For me, it was the freedom to decide, the power of choice, and the value of time. - Was there also some luck involved in all of this?

YES, but it’s something to see how my luck in these areas increased once I stopped carrying thousands of dollars of debt at 21% interest.

I may not have known exactly what I was working toward when I restarted my financial journey, but one thing I am absolutely certain of is that the path to financial wellness has given me choices and paid dividends—a return on investment —well beyond what any stock, bond, or bank account ever could.

Now, if I can only figure out a way to fix our political system. Let’s see, first…

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He is an Accredited Financial Counselor (AFC®), a WISE-Certified Personal Finance Educator, has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.